On 11th May, the Court of Appeal (Civil Division) reversed last year’s High Court decision to quash the relief from Section 106 planning obligation payments for small sites of 10 homes or fewer (under five in designated rural areas).

The original exemption was introduced by housing minister Brandon Lewis via ministerial statement on 28 November 2014. It was welcomed by small and medium sized construction firms, plus self and custom builders, as it freed them from paying £1,000s to councils for infrastructure projects and affordable homes levies.

These charges had the potential to kill off many projects on viability grounds because the additional costs had to come from a finite budget – and self-builders can’t just factor these expenses into the selling price like a developer can.

The original immunity was never made law; it was simply advice from government – and that’s why problems arose. Two local authorities, Reading and West Berkshire, challenged the guidance, claiming their need to raise affordable housing levies trumped the demand for small sites to be excluded.

At a hearing in July 2015 they won their case, so once again Section 106 levies applied to small sites and self-builders were left wondering what to do next. I know many projects were on hold just waiting for this decision to be made, such is the impact of these payments.

However, thanks to relentless campaigning by the National Custom & Self-Build Association (NaCSBA) and others, the Department for Communities and Local Government (DCLG) has made a successful challenge and the High Court decision to quash the exemption has been reversed with immediate effect.

It’s a good job, too, because the earlier ruling clearly contradicted the government’s intention and its stated commitment to double the size of the self-build sector to 20,000 homes per year by 2020. However, there’s still the possibility that the original appellants will seek leave to appeal in the Supreme Court.

The result begs the question as to why we should retain Section 106 agreements. The big players ignore them or negotiate around them, while property values in London and the south east make them a minor irritation to be factored into ever increasing prices. Smaller developers and self-builders are once again exempt.

By my reckoning, there will be a few medium-sized builders in rural areas picking up the tab and passing on the costs, which will inflate already expensive house prices, making new homes even more unaffordable than before. Given the confusion that already exists around Section 106 and Community Infrastructure Levy (CIL) charges, why not simply lump them together? Self-builders already have the legal exemption from CIL and the cost can be recouped from those best able to pay, so local authorities will get the vital revenues they seek.

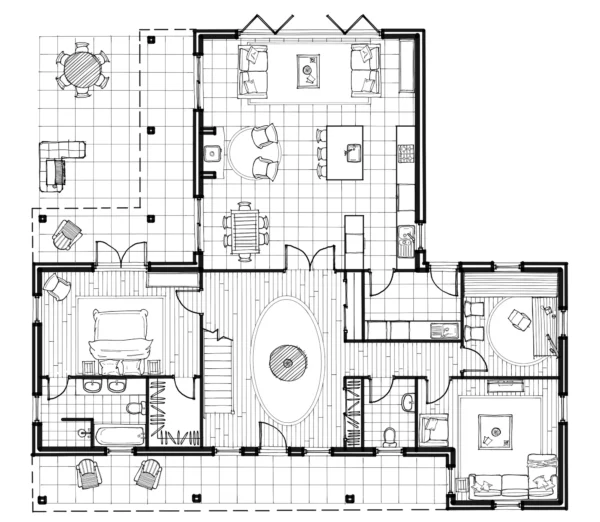

Image: A Model Kit Home

Login/register to save Article for later

Login/register to save Article for later