How to Choose the Right Site Insurance

For most of you, building your own home will be the biggest financial outlay you’ll ever make – and it will most likely involve spending every penny you have.

Undertaking a major extension or renovation project will also require significant investment.

It makes sense to put the right insurance in place, then, so as to protect our interests against unforeseen events that might scupper the best-laid plans of even the most organised among us.

Why is it important to have project insurance?

Self-building or renovating can be a risky business. A major scheme involves valuable heavy machinery and expensive materials waiting to be used.

Trades will also be working in dangerous environments – such as on roofs and scaffolding, with the accompanying risks of falling or being under something that’s dropped from height.

Furthermore, while the work goes ahead, part-built structures such as gable ends can be vulnerable to extreme weather events.

Free Advice about your ProjectTalk to the experts about your project and learn from their years of experience at Build It Live. Watch live presentations on a variety of topics and meet hundreds of suppliers, from glazing specialists to build system suppliers and insurance providers. Build It Live takes place three times a year in Kent, Malvern and Exeter. The next show will be on 21st and 22nd February 2026 in Maidstone, Kent. Claim a pair of free tickets today and start planning your visit. |

Learn more: Building a house in a flood zone

All of this is completely outside the normal remit of domestic building and contents insurance, which means you’ll need to secure a specialist product. Insurance is a risk-based industry and the risks associated with a building site are far higher and much more varied than the relative safety of a residential property.

It is for this reason that when you undertake an extension, or tackle serious renovation work to your current home, it’s essential you notify your insurer before the project starts.

Building work will increase the risk of something untoward happening to the property, so you may well find your premium increases for the duration of the scheme. Conversely, if you don’t notify them and damage occurs, they can refuse to pay out because of the change in circumstance.

If you find that your existing insurer isn’t interested in covering renovation or extension work, then you should strongly consider taking out a specialist policy. And you’ll certainly need to do so on a self-build project.

Won’t my builder have insurance?

It’s true that your contractor or trades should have their own insurance, and you should check this is in place when hiring them. But their cover alone will not safeguard all of your interests, particularly on a large-scale project.

Most trades will have public liability insurance, but to claim on this you have to prove negligence on their part, which can be an expensive and lengthy process. Your builder’s protection will also only apply against their interests and not necessarily yours. For example, their insurance will not cover your liability for the plot before work commences.

Obtaining a specialist policy with contractors ‘all risk’ insurance is particularly important for those of you planning to manage your own projects. By hiring in trades to do work for you, you become their employer and therefore can be held liable for incidents on your site. Claims for death or serious injury can and do run into millions of pounds.

What’s the difference between site insurance and a structural warranty?

These two products are often sold by the same providers, but they are entirely different types of cover and should not be confused. A typical site insurance policy will cover you for the following items during the works:

- Public and employer’s liability

- Building works & materials

- Plant, tools & equipment

- Site huts & temporary structures

- Existing structures (for conversions, extensions & renovations)

- Personal accident cover

- Legal expenses

Specialist site insurance policies are designed to last for the duration of the project only and can be offered for 12, 18 or 24 months. They can usually be extended to suit if things are taking longer than expected.

Similarly, if your project finishes early, it is often possible to convert the remaining term into buildings cover for the finished structure – although making the switch can attract a small surcharge from some insurers.

Structural warranties, on the other hand, provide a 10-year guarantee against structural defects in the design, workmanship or materials that went into the build. So they kick in after the project has finished.

The first two years are normally the responsibility of the builder, but serious issues that appear after this time are covered by the warranty.

Think of it as akin to car insurance: if you have an accident, someone fixes it and gives you a replacement vehicle for the duration of the repair. With a structural warranty, someone resolves the defect in your house and, if necessary, you get accommodated elsewhere whilst the work is going on.

Don’t confuse a structural warranty with an architect’s certificate, either. The latter is not insurance-based, so if a problem does occur post-build, it will be up to you to prove negligence and sue the designer.

How much does site insurance cost?

Like any insurance policy, the premium you pay is directly linked to the risks involved and the likely reinstatement (rebuilding) costs – so the price will vary depending on what you are constructing and where it is.

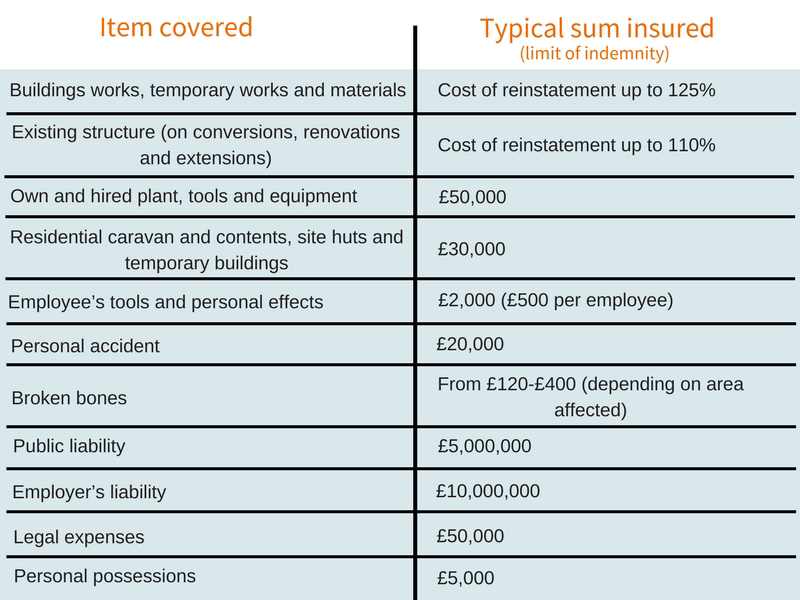

Typical site insurance coverageThe following table shows the summary of cover provided by a typical site insurance policy, in this case, the BuildCare product offered by Buildstore: |

I asked BuildStore for a typical quote for site insurance cover on a home with a £300,000 rebuild cost, completed on an 18-month project schedule – and the answer was around £1,200. This should give you some idea of the premiums involved.

No doubt you will be looking to make your budget stretch as far as possible, and I can understand how some people might look at the risks and decide that site insurance is a luxury – but I would strongly disagree. Like any policy, you buy it hoping you never have to use it, but when you do have reason to make a claim, you will be forever grateful that you had suitable cover in place.

If you are raising a mortgage, it is most likely that your provider will insist on both site insurance and a structural warranty being in place before they lend. So in reality, the decision can often be made for you.

Is it worth claiming?

In the years I’ve been involved with self-building, I’m happy to report I’ve not come across many situations where a claim has been necessary. But where it has been called for, the right policy has been a life saver.

Have a look at a past episode of Grand Designs, from 2008, and ask Tiffany and Jonny Wood if it was worth having site insurance for their project in Bath. Building on a hillside site, as they dug into the slope and installed the retaining piles, they uncovered an underground stream – and subsequently watched in horror as their neighbour’s garden started to slide down onto their plot. Thankfully, the couple’s site insurance paid up and the project was saved.

Petty pilfering on site can and does happen, but not as much as you might think. When it does occur, the scale is usually such that it’s hardly worth the hassle to make a claim. However, if an expensive piece of plant is taken, or if costly materials are stolen, it can seriously affect the viability of your project.

As with any insurance cover, your provider will expect you to take reasonable steps to minimise the risk of loss or damage. Sensible precautions, such as having a secure lock-up to store valuable tools and materials overnight, will bolster your case if you need to make a claim.

When should I take out site insurance?

The moment you exchange contracts on the land, you’re responsible for it. So from that point onwards, anyone suffering injury or loss on your plot, whether they should have been there or not, can claim against you.

It sounds unfair, but that is the law of the land, so you should be arranging for at least public liability cover on your plot from that moment. When building work starts, you should have site liability insurance in place to reflect the work being done. This should be adequate to cover the rebuild costs as they increase throughout the project.

For those of you undertaking renovation or construction projects on a professional basis, you will need to look at full contract works cover. This will be different to (and more expensive than) a self-build policy.

Top image: With demolition works and a steeply sloping plot to account for, securing a site insurance policy via BuildStore was a no-brainer for Sue and Fred Dow – even though, in the event, they didn’t need to dip into their cover. Read more

Login/register to save Article for later

Login/register to save Article for later